Manufacturing Salaries Plunged in 2024, and Why That’s Great News

The 2024 IndustryWeek Salary Survey showed a massive decline in average wages, but that reflects more young people working, not wage cuts at the top end.

In an ambiguous result for the manufacturing industry, average salaries reported by readers in our 2024 IndustryWeek Salary Survey fell almost across the board—$119,785.41 in 2024, 10.6% lower than the $133,996.66 reported in 2023. That nearly $14,000 salary decline, ironically, could be a good thing.

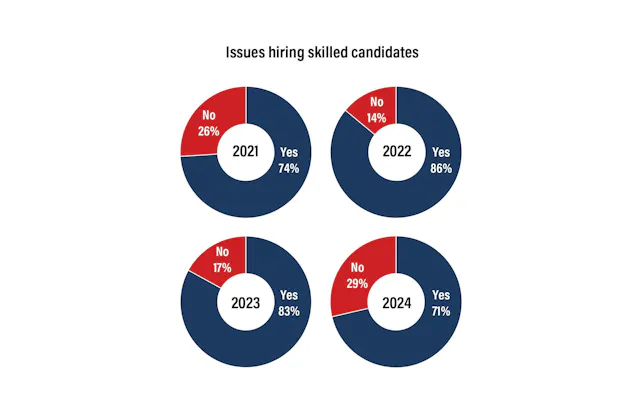

In a more positive sign, the number of respondents indicating difficulty hiring skilled talent fell to pre-Covid lows. That apparent increase in the number of new hires may help explain some of the dramatic loss in average pay.

A word of thanks is in order to everybody who responded to this year’s survey. The 2023 IndustryWeek Salary Survey received about two hundred useful responses: This year, we more than doubled that figure, with about four hundred responses. We couldn’t produce this analysis without your many diligent replies. Thank you.

Salary Slump

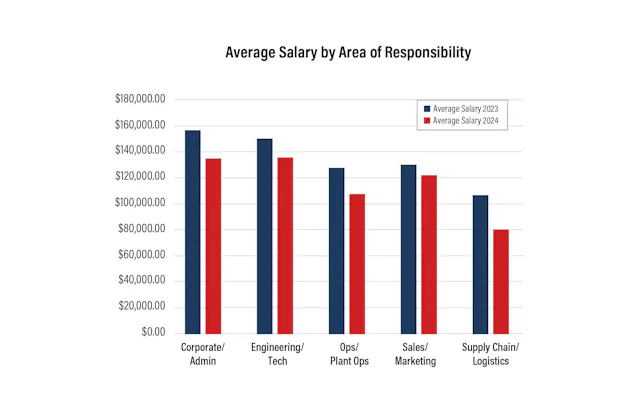

Average salaries were lower for almost every job function, but that likely reflected a broader demographic trend with younger, lower-paid workers participating in the survey in greater numbers.

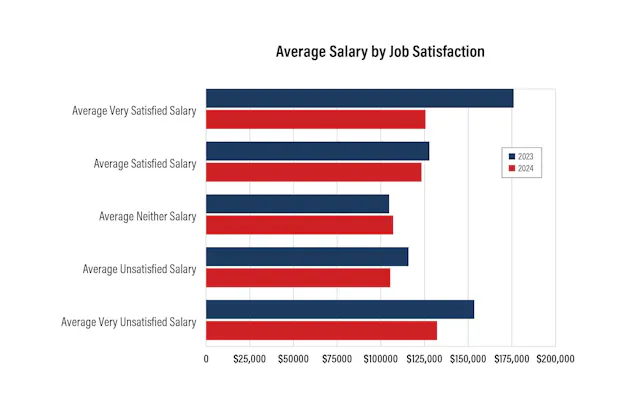

IndustryWeek readers reported lower overall salaries across almost all groups compared to their 2023 responses. Average salaries for each main area of responsibility were lower than they were in 2023, as were average wages for men, women, all surveyed ethnic groups except African-Americans, and every age group except those in their forties.

Intriguingly, responses to the question, “How has your base salary changed from one year ago?” suggest that salaries are largely growing. The plurality, 28.3%, indicated their base salary had increased between 3-5% from a year ago. Only 4.28% of respondents said their salaries had actually fallen, compared to 27.55% who reported no change and the majority, 68.17%, who said their salaries had increased by at least 1%.

As any data scientist (0.48% of respondents; average salary, $127,000) should respect, something changed with the data we’ve collected. The latest average private manufacturing salary reported by the Bureau of Labor Statistics is $44.17 an hour for the second quarter of 2024, representing an annual salary of about $92,000.

Since IndustryWeek’s articles on manufacturing leadership are often aimed at management positions (See the above point about C-suite representation), we could expect our average numbers to be higher. Considering that the 2024 survey more than doubled its sample size, it’s fair to infer that the new, lower average salaries may simply be more accurate than 2023’s figures.

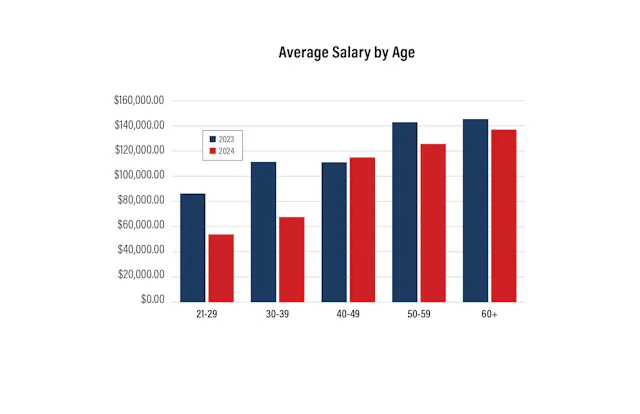

The biggest increases in survey participation took place at the young end of the scale with the biggest declines coming from older, higher-paid workers.

Older employees with more experience usually make higher wages, and last year, responses skewed older with only about one-in-five workers saying they were in their 40s or younger. This year, that group made up nearly one-in-three responses. Our results showed a similar percentage increase in respondents who had worked for their current employer for 10 years or fewer: in 2023, 46% of respondents fell into this category, while in 2024, 56% did.

If this increase in younger respondents isn’t merely a sign that IndustryWeek has become neato and keen with young people, then it could be a sign of genuine demographic change in the industry. It could suggest, amid a decades-long complaint of short talent supply, that manufacturing is getting an influx of fresh blood. Tantalizingly, responses to the question on skilled talent availability suggest just that.

Sourcing Talent, Challenges

In 2024, the number of respondents indicating their employer is having trouble sourcing skilled workers dropped to 71%, 12 points lower than 2023 and 15 points lower than 2022. Taken in concert with lower salaries, higher proportions of manufacturing workers with lower ages and less experience, this suggests that manufacturing is actually moving in a positive direction on hiring — glimmers of hope for an industry long concerned with a lack of available talent.

Responses to our question on company tenure also support this: Just under 20% of respondents this year have only worked at their current workplace for 1-2 years, a 7-point increase from 2023.

Survey participants noted the least trouble finding workers in the past four years, though the overwhelming majority of companies still struggle with recruitment.

Unfortunately, a strong influx of young talent making entry-level wages getting into manufacturing doesn’t answer all the data trends. Groups reporting lower salaries than previous years also included those in their 50s and 60s. While the survey doesn’t capture reports from laid off or retired employees, the results suggest that higher-paid older and experienced workers are retiring at higher rates.

More qualitatively, several survey comments on threats to manufacturing today included retiring workers with experience, a persistent lack of skilled new hires. “Manufacturing needs to start a retention program for senior employees,” wrote one respondent, a mechanical infrastructure specialist at a plastics & rubber firm who complained of “truly ignorant mistakes” made by new hires.

“We senior staff know what to do, but if no one asks us, the mistakes are repeated over again as the years pass,” he wrote. “If you want us to stay and help the new generations, give us some incentive and more autonomy with authority.”

Another commonly commented on difficulty: Language and ethnic barriers. In lieu of continuing to ask survey-takers about direct economic impacts of the Covid-19 pandemic, this year we added a question about diversity, equity and inclusion initiatives.

DEI Attitudes

Our survey found that just under half of respondents, 47%, worked at companies with formal DEI programs. While respondent comments suggested opinions of DEI programs skew negative to neutral, at least one respondent listed “workplace DEI social groups” as a means their employer was using to attract new employees, alongside “community involvement, interacting with schools with STEM support,” and giving to charity.

Most who mentioned DEI were ambivalent: A representative comment indicated that “DEI is not as important as supply chain[s] and retaining top talent.”

Questions about satisfaction indicated that most of our respondents are satisfied with manufacturing as a career and their jobs in it. A majority of respondents indicated they were satisfied or very satisfied with both, with slightly more reporting satisfaction with manufacturing as a career than with their jobs: 79.5% reported satisfaction with manufacturing versus 74% with their current jobs.

What they liked most about their jobs was, appropriate for the survey, the money: The plurality of respondents, 18.78%, listed “base salary” as the item that mattered most to them about their job. “Challenging work” was a close runner-up, taking 17.84% of respondents’ top priority, with “job stability” also on the podium with 12.44%. As an engineer in the additive manufacturing field put it, “Manufacturing is still one of the best industries to support a family.”

Who Responded in 2024

A plurality of respondents to the IW 2024 Salary Survey were members of the C-Suite, making up 16% of respondents and taking home an average of $203,059 per year, not including bonuses. The lowest-paid job function were administration workers: Making up 1.4% of respondents, they earned an average of $60,492 — lowest on the group, but notably higher than the average 2023 salary of just $41,600.

By industry, automotive equipment and industrial machinery businesses tied for a plurality, each accounting for 12% of results. Barring categories with fewer than a handful of respondents, the highest average salary was found in the electronics, high-tech, and telecom equipment manufacturing sector, featuring an average salary of $145,454. Oddly, the lowest-paid sector was its close cousin, computer equipment & peripherals: Workers there made an average of $62,725, less than half their high-tech peers.

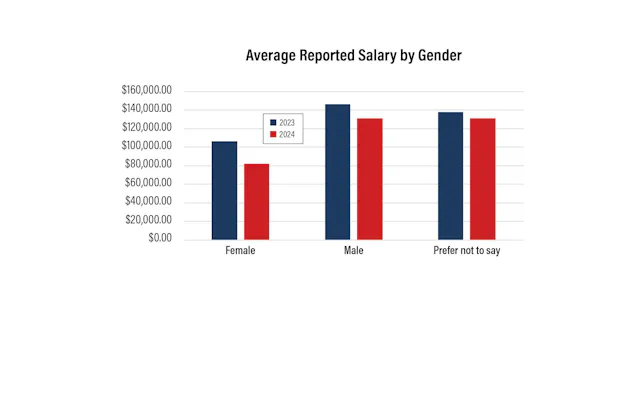

Average wages for men and women declined, a testament to the overall lower salary figures seen in the 2024 survey. Men, who made up 72% of respondents, made an average of $131,437 a year. Women made an average of $82,293, or $49,144 less than the average man, an increase from last year’s wage gap of $39,953. Both salaries were lower than their 2023 equivalents: the average salary for men and women fell by 10% and 23%, respectively.

2024 saw a strong increase in responses from African-American manufacturing workers this year, who made up 8% of respondents, up from just over 1% in last year’s numbers. Theirs was the only average salary by ethnicity not to show a decrease. The White/Caucasian majority of respondents also made the highest average salary, $126,101.

Those who called states touching the Pacific home had the highest salaries by geographic region of our readers, with an average salary of $129,672. That was just slightly higher than the North Central region featuring much of the Midwest, home to 40% of our respondents, where the average salary was $128,889. The East Coast had the lowest average salary by region with $101,521.

Written by: Ryan Secard, Associate Editor for Industry Week, reports on workforce and labor issues in manufacturing, including recruitment, labor organizations, and safety, for Industry Week.